Expert insights on financial planning for higher education: A guide for Indian families

By Saumya Tripathi, Head – Career Guidance, Good Shepherd International School

In today’s globalised world, higher education is an increasingly significant financial undertaking, especially for students in India aspiring to study abroad. A 2023 report on international student mobility indicates that Indian students represent a growing share of foreign students in many countries. In the US alone, Indian students constituted nearly 21% of the international student body, a 12% increase from the previous year.

Whether from IBDP or ISC curricula, Indian students are seeking opportunities in the US, UK, Canada, Europe and beyond. The costs associated with such education — tuition fees, living expenses, travel and personal expenditures — are rising, presenting families with tough choices. As a Career and College Guidance Counsellor working with students from premier curricula like IBDP and ISC, I have observed that financial planning for higher education is becoming a key concern for students and their families. A thoughtful, strategic approach to this process can greatly alleviate stress and ensure a smooth path to success.

The present scenario

Higher education, particularly overseas, is becoming more expensive each year. According to recent data, the average cost of attending a US university (including tuition and living expenses) can range from $70,000 to $95,000 per year. In the UK, undergraduate fees for international students often exceed £20,000 per year, with living costs adding around £10,000. In countries like Germany, where tuition fees are generally low or non-existent, living expenses can still be significant.

Given these figures, it’s no surprise that financial planning has become a central issue for students and families in India. Many parents are looking to start early by saving through child education plans, fixed deposits, or even mutual funds, while students explore scholarships and part-time work options abroad. However, even with these measures, the financial burden can be daunting.

Breaking down college expenses

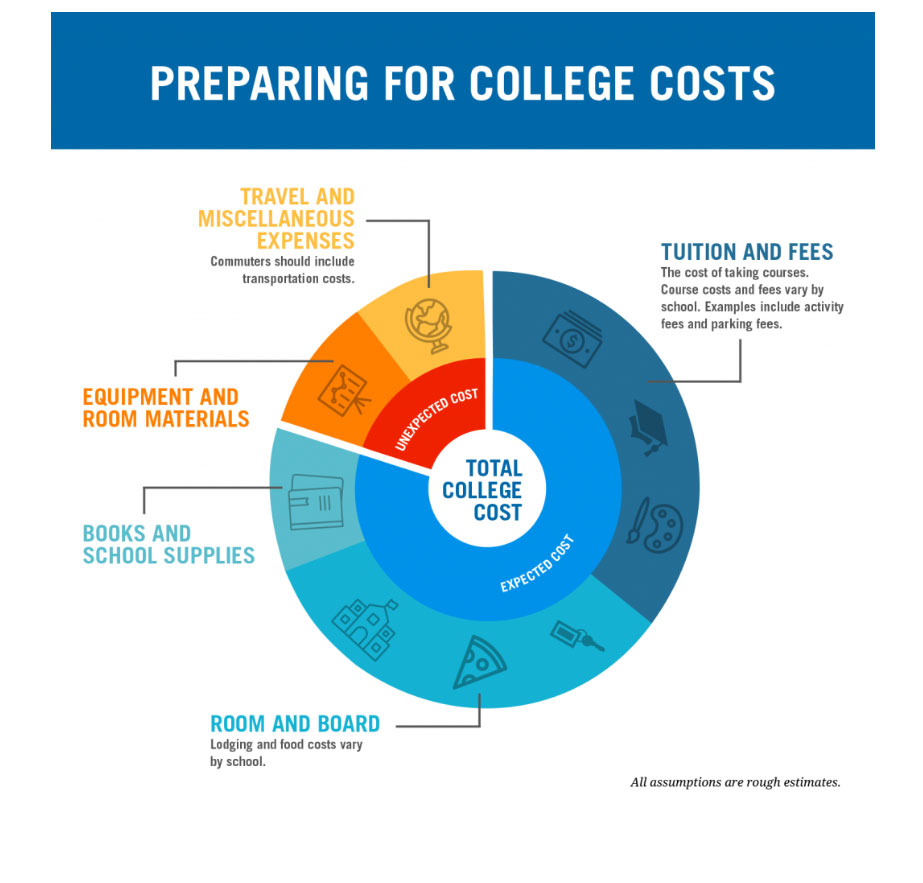

Families must divide and understand college expenses to make effective plans. Generally, the following costs need consideration:

1. Tuition fees: This is the largest chunk, varying significantly by country, university and program. For instance, the cost for an undergraduate program in the US is often higher than in European or Asian countries.

2. Living expenses: Housing, food, transportation and healthcare are other significant costs, particularly in cities with a high cost of living such as New York, London or Sydney.

3. Travel and miscellaneous expenses: Travel between India and the country of study, visa fees, and personal expenses such as books, entertainment and social activities.

4. Contingency funds: Unforeseen costs like emergency healthcare or unplanned travel also need to be factored into financial planning.

Challenges in financial planning

Many students and families struggle with financial planning for several reasons:

1. Lack of awareness: Some families underestimate the total costs involved, focusing only on tuition without accounting for living expenses or fluctuating exchange rates.

2. Scholarship uncertainty: Scholarships can ease financial pressure but are highly competitive and not guaranteed. Students often rely on scholarships to fund their education, leading to uncertainty when applying to colleges.

3. Exchange rate volatility: The fluctuation in exchange rates can dramatically increase the cost of studying abroad for Indian students. For instance, a sudden depreciation of the Indian rupee can increase tuition fees by 10-15% over the course of a few years.

4. Loan dependency: While education loans are available, they come with the pressure of repayment. Students might face challenges in securing high-paying jobs after graduation to pay off these loans, leading to financial strain early in their careers.

Solutions and pointers for effective financial planning

To mitigate these challenges, students and families can adopt several strategies:

1. Start early with savings: It’s essential to start saving early. Parents can invest in long-term education savings plans or mutual funds, which grow over time and can provide significant relief when the time comes to pay for college.

2. Explore scholarships and grants: Students should research scholarships early in the application process. Platforms like DAAD for Germany, Erasmus Mundus for Europe, or Fulbright for the US offer scholarships for Indian students. Additionally, university-specific scholarships should not be overlooked.

3. Consider cost-effective alternatives: Students should explore countries where education costs are lower. For instance, Germany offers free tuition at public universities for many programs. Countries like Sweden and Norway also offer affordable education.

4. Plan for exchange rate changes: Families should monitor the foreign exchange market and consider locking in favourable exchange rates via forex cards or other financial tools. It’s essential to have a contingency fund to cushion the impact of currency fluctuations.

5. Part-time work opportunities: Many countries allow international students to work part-time while studying. Students can offset living expenses by working on-campus or in nearby localities. It’s essential to research visa regulations to understand how many hours one can legally work.

6. Education loans with caution: While loans can help bridge the financial gap, they should be considered cautiously. Families should compare loan options, repayment terms and interest rates before finalising. It’s wise to calculate how much debt will be manageable based on expected post-graduation earnings.

Conclusion

Planning for higher education requires careful attention to financial details, a thorough understanding of the costs involved and the exploration of various funding options. As a counsellor, I encourage families to have early discussions about finances, start saving early and explore scholarships and grants actively. Students should also remain flexible in their choices, considering countries and programs that offer quality education at more affordable rates.

A well-planned financial strategy can significantly ease the burden of funding higher education, enabling students to focus on their academic and personal growth during this transformative phase of their lives.