On 16–17 June 2022, IFMR Graduate School of Business at Krea University played host to the third edition of the Research Symposium on Finance and Economics (RSFE) 2022. Eminent keynote speakers and more than 50 academics came together to present, discuss and deliberate on critical narratives in the field of Finance and Economics

The Research Symposium on Finance and Economics (RSFE) 2022 that was held on June 16 and 17, this year, received 83 papers from academicians and scholars from Oxford Said Business School, University of Cambridge, Yale School of Management, Cornell University, The University of Queensland, Chukyo University, Hong Kong University of Science and Technology, Kellogg School of Management, Northwestern University, Indian Institute of Management Ahmedabad among many other prestigious global institutions.

The inaugural day of RSFE 2022 witnessed three keynote lectures, three technical sessions and 28 paper presentations from academics spanning eight countries and over 28 universities across the globe.

In his welcome address, Professor Praveen Bhagawan, Chair, RSFE 2022 and Assistant Professor of Finance and Area Chair (Finance) at IFMR GSB said, “RSFE is an important event in the academic calendar of IFMR GSB. More than 50 researchers from India and abroad will present their highly esteemed research in the areas of finance and economics this edition. The aim of the Symposium is to create a forum for discussion and deliberation on emerging issues in finance and economics.”

In her opening remarks, Prof Lakshmi Kumar Dean, IFMR GSB, Krea University said, “Historically, IFMR has always been a research institution around finance and economics. In both areas IFMR has made significant contributions as we have introduced models to understand what moves markets and made significant contributions towards economic policy. With the introduction of the Research Symposium, the quality of research has moved up exponentially. It was tough to select papers for the Symposium as the quality was very high.”

Addressing the attendees, Ramkumar Ramamoorthy, Pro Vice-Chancellor, Professional Learning, Krea University, said, “There has been a structural alteration of the business landscape – technology has become the language of business and sustainability its underlying grammar. IFMR has focused on finance and economics for more than five decades. This institution has the distinction of having a very strong association with the government of India with several distinguished academicians having served the government in very high posts. Given this context, I am thrilled that IFMR GSB has taken the lead to organise this Symposium and also invited so many illustrious speakers.”

The inaugural and Keynote Address presentation by Prof Itay Goldstein, Joel SEhrenkranz, Family Professor of Finance and Professor of Economics, Wharton School, University of Pennsylvania, United States, touched upon the results of a study on how environmental, social and governance (ESG) investing re-shapes information aggregation by prices. “Investors are increasingly showing interest in other aspects of a firm’s operation namely ESG – Environmental, Social and Governance. This is a revolution for the way asset markets work since now there are investors who are potentially interested in different things – cash flow vs ESG”, he added.

Prof Raghavendra Rau, Sir Evelyn de Rothschild Professor of Finance, Judge Business School, University of Cambridge, United Kingdom, delivered his Keynote Lecture titled “Information Processing in IPOs: The Case of Board Gender Diversity”, examining the impact of board gender diversity on the underpricing of initial public offerings (IPOs).

Prof Rau said, “IPOs with at least one woman on the board are significantly more underpriced than IPOs with all-male boards. The underpricing effect is not attributable to performance, growth opportunities, CSR profiles, or other firm characteristics. Instead, the underpricing effect appears to be driven by increased institutional investor demand for board gender diversity. Over the past decade, institutional investors and firms have placed increased emphasis on stakeholder value maximisation, diversity, and other CSR related topics.”

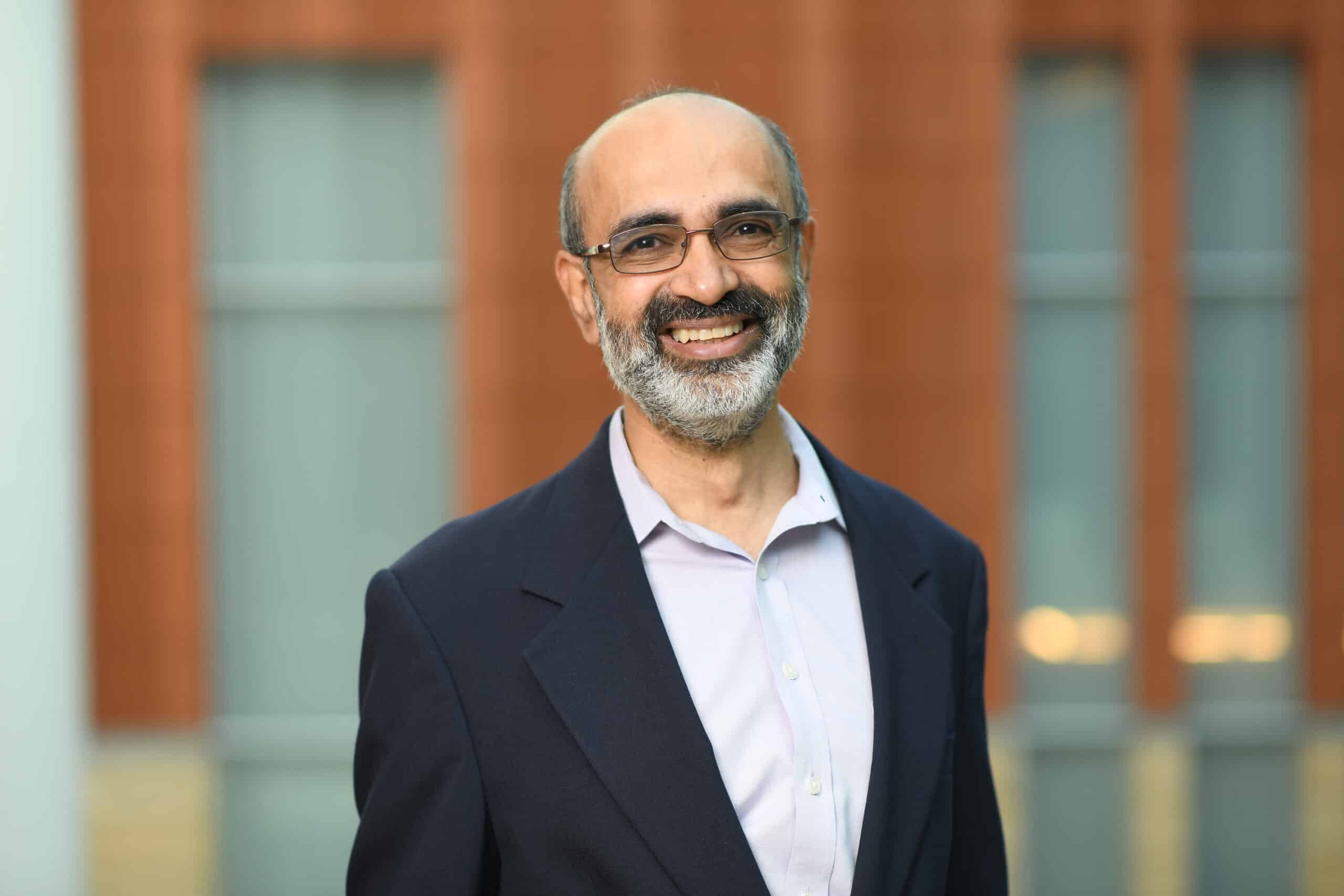

Prof Uday Rajan, David B Hermelin Professor of Business Administration and Professor of Finance, Stephen M Ross School of Business, University of Michigan, United States delivered his Keynote Lecture titled “FinTech and the Boundaries of the Bank”. Prof Rajan focused on FinTech competition in payment, observed in recent years. He discussed some innovations in payments, such as those which use existing bank and credit card infrastructure (Paypal, Paytm, Square, Venmo) and those based on new technology by-passing the banking system (Alipay, WeChat Pay and M-Pesa).

The second and concluding day of the Symposium witnessed three Keynote Lectures, three technical sessions and 26 paper presentations from academics spanning 41 universities across 11 countries.

Prof Campbell R Harvey, J Paul Sticht Professor of International Business and Professor of Finance, Fuqua School of Business, Duke University, United States, delivered his Keynote Lecture titled “DeFi: Opportunities and Risks”. In DeFi or Decentralised Finance, users interact as peers with algorithms or smart contracts rather than through traditional intermediaries such as banks, brokerages, or insurance companies. “DeFi is the future of financial transactions”, said Prof Harvey.

During her Keynote Address at RSFE 2022, Prof Ashima Goyal, Member of Monetary Policy Committee, Reserve Bank of India and Emeritus Professor at IGIDR, India, said that India has been going through a very tough time and there were all kinds of preconceptions and predictions that the Indian financial sector is fragile, cannot recover without major reforms, there exists a trust deficit, PSBs are the problem and privatisation is the only answer; but the financial sector has really surprised everyone by outperforming during this period.

Prof Ashima said, “India has the largest share of youth and combined with technology, innovation and inherent resilience there is great opportunity to kick-off a virtuous growth cycle, with inclusion largely from empowerment” she added. Ending with a word of caution, she said though the sector performed beyond expectations there were still lots of risks and uncertainties that one should be careful of. Excessive stimulus or tightening can prove countercyclical for the Indian financial sector.

Prof Nishith Prakash, Associate Professor of Economics, University of Connecticut, United States, delivered the last Keynote Address titled “Improving Girls’ Education: Evidence from Two Countries”. He shed light on how despite considerable progress in closing the gender gap in education, there still exist several barriers to human capital accumulation for girls in developing countries, such as distance to school, safety and violence, lack of agency and socio-cultural barriers. In this talk, Prof Prakash provided both experimental and non-experimental evidence from India and Zambia.

Research papers were called for various topics in the field of Finance and Economics, including Corporate Finance, Capital Structure and Dividend Policy, Corporate Governance, Mergers and Acquisitions, Financial Reporting and Regulations, Behavioural Finance, Computational Finance and Financial Econometrics, Asset Pricing, Financial Markets, Derivatives Trading and Pricing, Market Microstructure and Algorithmic Trading, Banking and Risk Management, Digital Finance, Financial Tech, AI, and Machine Learning.

RSFE 2022 concluded with the presentation of the ‘Best Paper Awards’ in the areas of finance and economics. The awards were sponsored by CFA Institute and IFMR GSB.