The blog is written by Amit Agrawal. The Author is a MBA student of IFMR GSB at Krea University.

The Era of the Fourth Wave?

Total worldwide debt had never been higher. And yet, there’s a little sign of this current wave retreating any time soon. Now with the Coronavirus outbreak being declared a pandemic, governments have announced hundreds of billions of dollars in stimulus packages that will send debt even higher. So, how worrisome is the situation currently?

Global borrowing is growing rapidly so much so countries fear that it might be on the verge of unsustainability. The Institute of International Finance estimates total worldwide debt (which includes borrowings from households, companies, and government) surpassed $253T at the end of September 2019. It is more than thrice the global GDP, 2018 ($84T). This accounts for a $32,500 debt per person for 7.7 billion people. IIF worries more as it is only going to increase.

The World Bank believes the speed and scale of this debt wave is something we should all be worried about. It has asked all governments to make it a primary concern.

Talking in lay man’s terms, debt is created when one party borrows from another to buy something, they wouldn’t normally be able to buy. The interest rate plays a crucial role here. At present, interest rates around the world have fallen to historically low levels. This has made it cheap to borrow from banks.

Recently, the United States (The Fed, led by Chair Jerome Powell) slashed the interest rates to zero as part of wide-ranging emergency intervention. Fed would be buying at least $700 billion in government and mortgage-related bonds as a part of a wide-ranging emergency action to protect the economy from the impact of coronavirus. The move, the most dramatic by the US central bank since the 2008 financial crisis, is aimed to keep financial markets stable thus making borrowing costs as low as possible due to business shutting down globally and the US economy hurtles toward recession.

In addition to rate cuts, the Fed announced that it is restarting the crisis-era program of bond purchases known as “Quantitative Easing”, in which the central bank buys hundreds of billions of dollars in bonds to further push down rates and keep markets flowing freely.

The Fed’s action to inject a large $1.5 trillion into the bond market ensures sufficient liquidity.

Trump has urged the Fed to make the nation’s interest rates negative, something that has never happened before in the United States. Powell said it was unlikely he would make U.S. rates negative. Negative rates work by effectively paying borrowers to take out loans and requiring people and businesses that deposit money to pay a fee rather than earn interest (Source: The Washington Post on March 16, 2020).

But what actually happens when the interest rate plunges in the economy?

The Federal Open Market Committee (FOMC) of the Federal Reserve meets regularly to decide what to do with short term interest rates. When the Fed “cuts rates”, this refers to a decision by the FOMC to reduce the federal fund’s target rate (Source: investopedia.com). The target rate is a guideline for the actual rate that banks charge each other on overnight reserve loans. Rates on interbank loans are negotiated by the individual banks and usually stay close to the target rate.

The Fed lowers the interest rates in order to stimulate economic growth. Lower financing costs can encourage borrowing and investing. However, when rates are too low, they can spur excessive growth and perhaps inflation. Inflation eats away at purchasing power and could undermine the sustainability of the desired economic expansion.

[Financing] A rate cut could help consumers save money by reducing interest payments on certain types of financing that are linked to prime or other rates, which tend to move in tandem with the Fed’s target rate.

[Mortgages] A rate cut can prove beneficial with home financing, but the impact depends on the type of mortgage the consumer has (fixed or adjustable). For Fixed-rate mortgages, a rate cut will have no impact on the monthly payment amount. A Fed rate cut changes the short-term lending rate, but most fixed-rate mortgages are based on long-term rates, which do not fluctuate as much as short-term.

The link between inflation and mortgage rate is direct. Inflation is an economic term describing the loss of purchasing power. When inflation is present within an economy, more of the same currency is required to purchase the same number of goods. More money is required to purchase the same amount of item(s) because each dollar holds less value. Meanwhile, mortgage rates are based on the price of mortgage-backed securities (MBS) and mortgage-backed securities are U.S. dollar-denominated. This means that a devaluation in the U.S. dollar will result in the devaluation of U.S. mortgage-backed securities as well. When inflation is present in the economy, then, the value of a mortgage bond drops, which leads to higher mortgage rates.

This is why the Fed’s comments on inflation are closely watched by Wall Street. The more inflationary pressures the Fed fingers in the economy, the more likely it is that mortgage rates will rise.

[Savings Account] Consumers usually earn less interest on their savings due to interest rate cuts. Banks will typically lower rates paid on cash held in bank certificates of deposits (CDs), money market accounts, and regular savings accounts.

[Sovereign Debt] Governments take on debt which they can use to stimulate the economy by funding infrastructure. It becomes a matter of concern if any of the debts become excessive.

Loans to countries with developed economies, like Canada, Denmark or Singapore, are generally seen as safe investments. That’s because even if governments spend beyond their means, lawmakers can raise taxes or print more money to ensure they pay back what they owe. But loans to governments in emerging markets are generally seen much riskier which is why these countries will sometimes issue debt in a foreign, more stable currency. Although this allows them to attract more investors from abroad looking for bigger returns, an economic slump, weak domestic currency or high debt burden can make it difficult for governments to pay them back.

The most important risk, that comes to national borrowing, is countries not able to pay debt obligations and default. For example, the Russian Financial Crisis in 1998, the Argentinian Crisis in 2001, and recent Lebanon in 2020. Over the last 50 years, there have been four waves of debt accumulation – 1970-89, 1990-2001, 2002-09, and 2010-present. We are currently in the midst of the fourth wave.

In the first wave, many Latin American and Caribbean countries (LAC) began to borrow extensive amounts of money from US commercial banks and other creditors to support development. There wasn’t any problem faced by both parties. Interest rates were low and Latin American economies were flourishing. But in the background, the debt wave was rising. At the end of 1970, the region’s total outstanding debt reached a height of $29 billion. By the end of 1978, that number had shot up to $159 billion. Four years later, it had more than doubled to $327B (Source: Federal Deposit Insurance Corporation, 1997). In the 80s, major economies began hiking up their interest rates as they baffled inflation. Oil prices were sliding, and the world economy was entering a recession. In 1982, the starting gun of Latin American debt crisis was effectively fired, when Mexico announced it would not be able to service its debts. This move quickly sparked a meltdown across the region, with a fallout spreading to dozens of emerging economies worldwide. The debt crisis of 1982 marked the end of the Import Substitution Model (ISM) (Source: scielo.br). In 1983 Mexico, like other Latin American countries, started the transition to a Neoliberal Model (NM), a model of an open economy, facing outward, characterized by the conversion of manufactured exports into the axis of accumulation pattern. Many Latin American countries were forced to devalue their currencies to keep exporting industries competitive in the face of a sharp economic downturn (Source: World Bank, 2020). Between 1981 and 1983, Argentine Peso weakened against the US $ by 40%, Mexican Peso by 33%, and Brazilian Real by 20%. (Source: World Bank, 2020). Overall 27 countries rescheduled their debts; out of which 16 were in Latin America (Source: Federal Deposit Insurance Corporation, 1997).

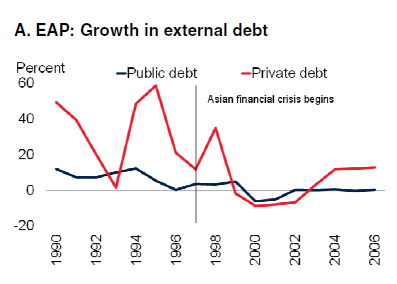

The second wave ran from 1990 to 2001 – It was unlike the first wave, here, debts in the private sector played a pivotal role. As we know, in the late 80s and early 90s, many advanced economies deregulated their financial markets. The policy changes made way for the consolidation of banks due to which these bigger bank operations became increasingly global. This helped prompt a massive surge of capital into emerging markets, with falling interest rates and a slowdown in advanced economies also fueling the surge. Developing economies on the other hand started to withhold a lot of debt, especially Malaysia, Indonesia, South Korea, the Philippines and Thailand.

Yet the growing wave of debt went largely unnoticed, as the debt was growing rapidly but so was GDP. This means the ratio between the two remained consistent. And from the graph we see that most of the debt remained latent in the private sector.

A currency crisis in Mexico in 1994 thrust international investors back into panic-mode, with a country’s default a decade earlier was not being a good relief. Yet, while a $50 billion bailout from the US and the IMF meant that Mexico was narrowly able to avoid a default this time. But it wasn’t able to stop ‘defaults’ lurking at the doors of other countries. It led to abrupt stop and reversal of capital flows in 1997. By this time Malaysia, Indonesia, South Korea, the Philippines and Thailand had developed a dependence on borrowing. Coupled with several other policy failings, this surged into a crisis in East Asia’s financial sector leading to another global downturn. While other countries recovered from the Asian Financial Crisis, international borrowing followed at a brisk pace.

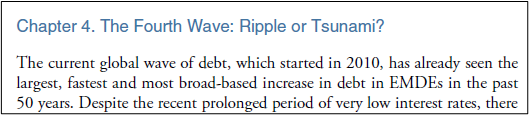

We now enter into the Third Wave which lasted from 2002 to 2009. At the end of the previous century, the US removed barriers between commercial and investment banks, while the European Union (EU) encouraged cross-border connections between lenders. This paved a way for the formation of so-called “megabanks”. These banks led to a sharp increase in private sector borrowing, particularly in Europe and Central Asia (ECA). Defaults in the US subprime mortgage system piled more and more pressure in the country’s financial system, pushing it to the brink of collapse in the second half of 2007 and 2008. The shockwave reverberated across the world, with one economy after another falling into a deep, albeit short-lived (Source: cnbc.com), recession. In 2009, the US recession hit its lowest level of economy since the Great Depression. The World Bank, in its latest edition of ‘Global Waves of Debt: Causes and Consequences’, says that we’re currently in the midst of the fourth wave of Global Debt. So in order to learn from the last three crises and avoid debt, governments must maintain a debt management system and transparency a top priority. This wave had seemed to cover all emerging markets and developing economies (EMDEs). It follows the same characteristics of the previous three including prolonged periods of low-interest rates and changing financial landscapes which encourage more borrowing.

But the World Bank has called the current wave as “the largest, fastest and most broad-based” of them all. It includes concurrent build-up of public and private debts, involves new types of creditors and is much more global.

With the Arab Spring uprising from 2010 in Egypt and previous encounters in other parts of the Middle East led to a significant drop in economies of the Middle East further fueled by political instability. Five years after the Arab Spring uprisings began (2015), Egypt, Jordan, Morocco, and Tunisia have achieved reasonable levels of political stability. Yet economic growth remains tepid, and the International Monetary Fund does not expect the pace of expansion to exceed 1.5% per capita this year (Source: imf.org, Articles 2015). Despite significant progress in building stable governments, these countries remain subject to political risks that scare private investors. But private investment was modest before the uprisings of 2011, when such risks were already high (Source: weforum.org).

However, as the Coronavirus pandemic threatens to sink the world economy, the moment of stemming the tide may have passed.

GLOBALISATION AND DEBT CRISIS

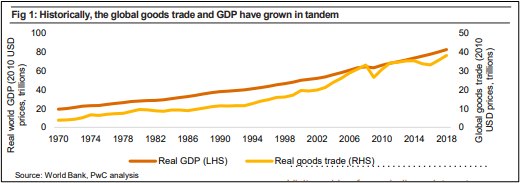

A defining feature of the global economy since at least the 1970s has been globalisation—the bringing together of economies predominantly via more liberal trade flows (Source: pwc.com). The global volume of merchandise traded slowed down dramatically and even went in reverse in 2019 in contrast to a 21st-century average growth rate of about 3.4% per annum (Source: CPB World Trade Monitor). In his 1989 essay, ‘The End of History?’, political thinker Francis Fukuyama famously predicted the triumph of liberalism, which became a catalyst for globalisation and the associated liberalization of the economy. The fall of the Soviet Union, which many happily attributed to as the fall of the socialist order, and the downfall of states that leaned towards the left spectrum of ideologies, gave way to internal tumult — signaling that the juggernaut of neoliberalism was unstoppable (source: thehindubusinessline.com). The new model was a consequence of global trends to shift production systems overseas as a result of the “great crisis” started in the late 1960s in the major developed countries, following the end of the long boom of the post-world war period. Globalization became a strategy to “step out” of the crisis for the most powerful and internationalized banks. In turn, indebted countries, large domestic private groups, corporations and banks operating within it, as well as governments, found in globalization an option to convert their businesses and focus them on the foreign market, in the Mexican case mainly the United States.

This graph shows that growth in merchandise trade flows and the global economy have been intrinsically linked. In our main scenario for 2020, we expect the global economy to expand at a rate of around 3.2% in purchasing power parity (PPP) terms which is below the 21st century average of 3.8% per annum. In our main scenario, we expect all of the major economies to grow by accommodative financial conditions. US economic activity is likely to expand by around 2%, in line with its potential rate.

But countries are going to be extremely wary of the superpower that China will become and would like to disengage. Stimulus packages — be it in the US, France, Germany — have an overwhelming emphasis on small businesses, which really were at the heart of their post-war industrialization strategy, and one will see industrial policy whose flip side will be import substitution. So, globalisation will be defined in a very different way. Once you talk of import substitution, you focus more on your domestic skills. The movement of personnel will follow the formula of economic needs, so the U.S. may keep importing skilled personnel from India (Source: thehindu.com/opinion).

Countries will reconfigure their economies to look at import substitution with greater clarity now, as the perils and pitfalls of overdependence on foreign supplies become clear. Import substitution, that had become a bad word, maybe back in currency.

‘Festina lente’: More haste, less speed

The Slow Food Movement which started in the 1980s to refrain people from eating fast food, slowly turned towards affecting Globalisation. To a world addicted to ever greater connection speeds, ever faster modes of transportation, and ever more caffeinated feats of multitasking, the go-slowers recommend a perverse resistance to the frenzied scherzo of modern life in favour of a more comfortable adagio (Source: business-standard.com). In the year 2018, The Economist identified several key factors of what it calls “slowbalisation”. The portion of trade as part of the global GDP has fallen. Multinationals have seen a drop in their share of global profits. FDI tumbled from 3.5 percent of global GDP in 2007 to 1.3 percent in 2018. The US-China Trade War further fuels the entire breakdown. Other reasons that pop up here are the falling costs of moving goods. This directly impacts the services as it is harder to sell services across borders. But this slowbalisation affects positively, as claimed by the Business Standard, as it reduces global carbon footprint, shrinks economic inequality, and reorient national economies toward local growth. The world today faces a number of crises. And that’s why ancients were right when they coined ‘Festina Lente’: more haste, less speed.

Economic globalisation has been a part of the world system since the Silk Road and even earlier. But the modern version dates to the late 19th and early 20th centuries, when railroads, telegraphs, modern factory production, and mass migration converged to create a new worldwide web of connections. As a result of global network, trade increased exponentially until 1914. The outbreak of WWI stopped globalisation at its tracks. It is now fine to claim that it was only after the first World War international NGOs were being able to establish. But this too did not last long. It was only after WWII did another attempt of rebuilding the international community began with the creation of the United Nations and a set of international financial institutions.

Slowbalisation will be meaner and less trouble than its predecessor. It is evident from the fact that globalisation, though it made the world a better place for everyone, too little was done to mitigate its costs. Acknowledging costs and benefits of Globalisation is not enough. We must pay attention to uneven distribution of those costs and benefits. The challenge is now to preserve the political internationalism necessary to address global problems and retrofit global economy to meet the needs of the people and the planet.

The fear and panic triggered by the virus has wreaked havoc in global financial markets. FT says there is a potential warning signal of global recession. The newspaper’s editorial is, interestingly, titled “Coronavirus has put globalisation into reverse…The spread of the epidemic amounts to an experiment in deglobalisation.”The global public response towards the coronavirus pandemic reaffirms such concerns. COVID-19 has given rise to four crucial learnings. The first is the failure of private capital and privatized medical care in ensuring proper healthcare for the public at large. Second, companies cannot take comfort in the fact that poverty, unhygienic conditions or precarious health infrastructure in one remote country is none of their business. This is the globalisation of responsibility, and not globalisation for the sake of profits alone. The third factor is that socialist regimes are better positioned to respond to emergencies. The fourth and most crucial insight is that public problems require public solutions. By default, neoliberalism simply cannot offer answers. The future, especially considering the collapse of globalisation, lies in ensuring a world order where resources are distributed in a much more egalitarian way and are controlled by the public.

With the onset of the quarantine lockdowns and curfews as solutions against the pandemic, there has been a talk about the world pushing toward the gig economy. Nagesh Kumar, Director, UN Economic and Social Commission for Asia and the Pacific (UNESCAP) said in an interview with The Hindu, “The first priority of every government would be to create jobs for its own people. In a high unemployment scenario, hiring ex-pats won’t be in favor. In any case, there had been rising protectionism on this front already.” Gig economy foresees the traditional economy of full-time workers who rarely change positions and instead focus on a lifetime career. The people we see around are mostly willing to work part-time or in temporary positions, not because of their inability to crack highly paid jobs but due to overpopulated competition within a handful of sectors. Youngsters find themselves at ease and are often dependent on these gigs (Ola, Uber) as their primary source of income and bereft of any access to any form of health insurance or social security cover. They can therefore scarcely consider taking time off work for any reason. This precariousness could now pose a massive threat to the public interest as these workers tend to interact with dozens of people a day and could become the new “super-spreaders” of the coronavirus. Workers at the frontline must, therefore, be provisioned accordingly to make them more resilient, and also provided with a safety net robust enough to enable them to take time off work if they feel symptomatic or support them in the event of a total lockdown.

Finally, the gravity of this crisis demands a change in individual behavior and social norms at their core. Only a change in individual behavior can eventually lead to the world overcoming this crisis. We must fortify our communities even as we practice physical isolation. One person’s precariousness is now society’s problem.

References

https://www.weforum.org/agenda/2016/03/what-happened-to-economic-growth-after-the-arab-spring

https://www.pwc.com/gx/en/issues/economy/global-economy-watch/assets/pdfs/predictions-2020.pdf

scielo.br/scielo.php?pid=S0103-40142012000200005&script=sci_arttext&tlng=en

https://www.ft.com/content/e5739928-ec58-11e9-a240-3b065ef5fc55

https://www.theguardian.com/business/2020/jan/08/world-bank-global-debt-crisis-borrowing-build-up

https://www.worldbank.org/en/research/publication/waves-of-debt

https://www.iif.com/Research/Capital-Flows-and-Debt/Global-Debt-Monitor

https://www.washingtonpost.com/video/business/fed-chair-powell-slashes-interest-rates-in-emergency-move-to-counter-coronavirus/2020/03/16/57f62623-0c06-4543-9bb1-76323a60f18d_video.html

https://www.investopedia.com/articles/economics/08/interest-rate-affecting-consumers.asp

https://youtu.be/ZQlLOe0Z1eg

https://www.investopedia.com/terms/p/primerate.asp

https://economics.rabobank.com/publications/2013/september/the-russian-crisis-1998/

https://www.brookings.edu/wp-content/uploads/2016/06/11_argentina_kiguel.pdf

https://www.investopedia.com/terms/t/target-rate.asp

https://www.fdic.gov/about/strategic/report/97Annual/

https://www.cnbc.com/2020/01/14/global-debt-hits-all-time-high-of-nearly-253-dollars–iif-says.html