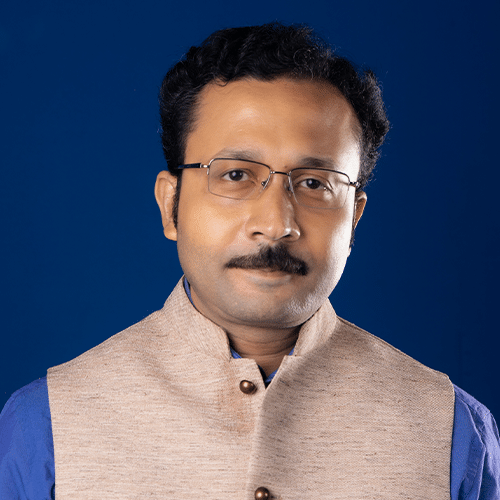

PhD Programme Chairperson's Message

The IFMR GSB’s PhD Programme, now under the aegis of the Krea Doctoral College, has focused on cutting-edge research in finance and management since the inception of the programme in 1982 as part of the then IFMR (Institute for Financial Management and Research). The diversity within Krea University and the interdisciplinary approach to research have further enhanced the quality of the doctoral curriculum at IFMR GSB.

The doctoral coursework has two phases. The first phase comprises the first two years, during which the doctoral scholars undergo selected graduate-level (MBA level) and doctoral-level courses which lay the foundation of research by exposing them to various functional areas (Data Science & Information Systems, Economics, Finance, Accounting, & Quantitative Finance, Marketing, Operations, Organisation Behaviour, and Strategy) within management. The coursework helps PhD scholars gain an in-depth understanding of management research from both theoretical and applied perspectives, thus preparing them to become successful management educators. In addition to various courses, an integral part of the coursework is the Independent Research Study, which prepares the PhD scholars to embark on writing their doctoral dissertation by instilling in them the required research skills. At the end of the first phase, PhD scholars need to qualify in comprehensive oral and written examinations.

The second phase begins from the third year when the PhD scholars start working on their research topic under the guidance of faculty members. During this phase, PhD scholars make presentations periodically to update the progress made in doctoral research. Finally, the doctoral degree is awarded after the submission of the thesis, its subsequent evaluation by external subject experts, and a successful public viva-voce.

Krea University provides generous financial aid to PhD scholars and strongly encourages them to participate in reputed peer-reviewed conferences, colloquiums, and workshops both in India and abroad. The library at Krea University has a rich collection of books, journals, and periodicals and subscribes to several databases required for empirical research.

It gives me immense pleasure to inform you that our PhD graduates have joined reputed academic institutions and research organisations in the past.

If you are keen to embark on an enriching journey of doing doctoral research, please reach out to us.

Chairperson, PhD Programme

IFMR GSB, Krea University