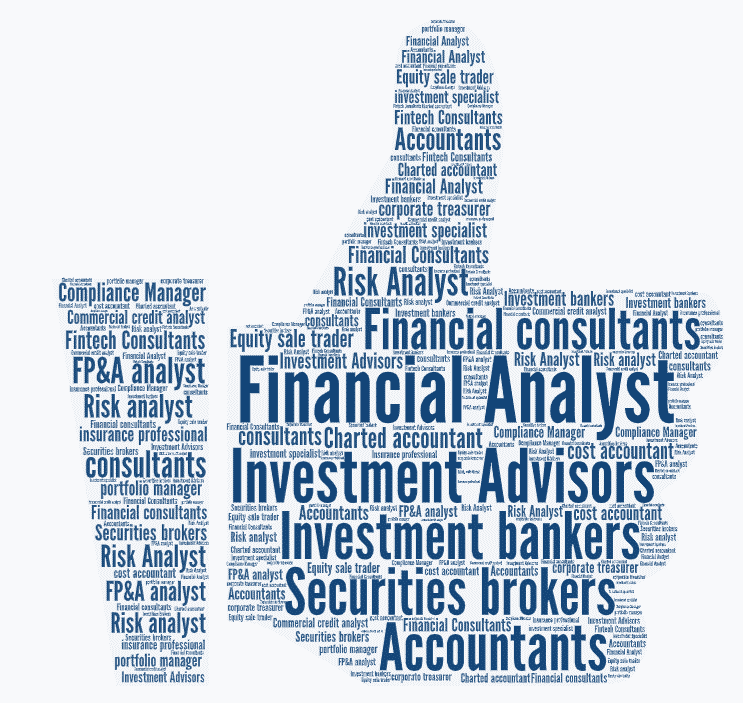

Academics & Curriculum

The immersive learning experience comes with an intensive application-oriented curriculum. The programme strengthens the foundation in core financial concepts and other prerequisite skill sets such as programming, mathematics and statistics before leading the learner into a rigorous and advanced understanding of financial analytics and fintech, and quantitative finance.

Conceptual Foundations in Finance

130

hours

-

Financial Accounting

-

Corporate Finance

-

Foundations of Mathematics and Statistics

-

Programming for Finance

-

Introduction to FinTech

-

Financial Markets & Institutions

-

Introduction to Machine Learning

-

Investment Analysis

-

Financial Career Lecture Series